Lower your tax burden and put your money to work.

At Baldridge Financial we understand that real estate investors have better uses for their capital than locking it up by paying taxes.

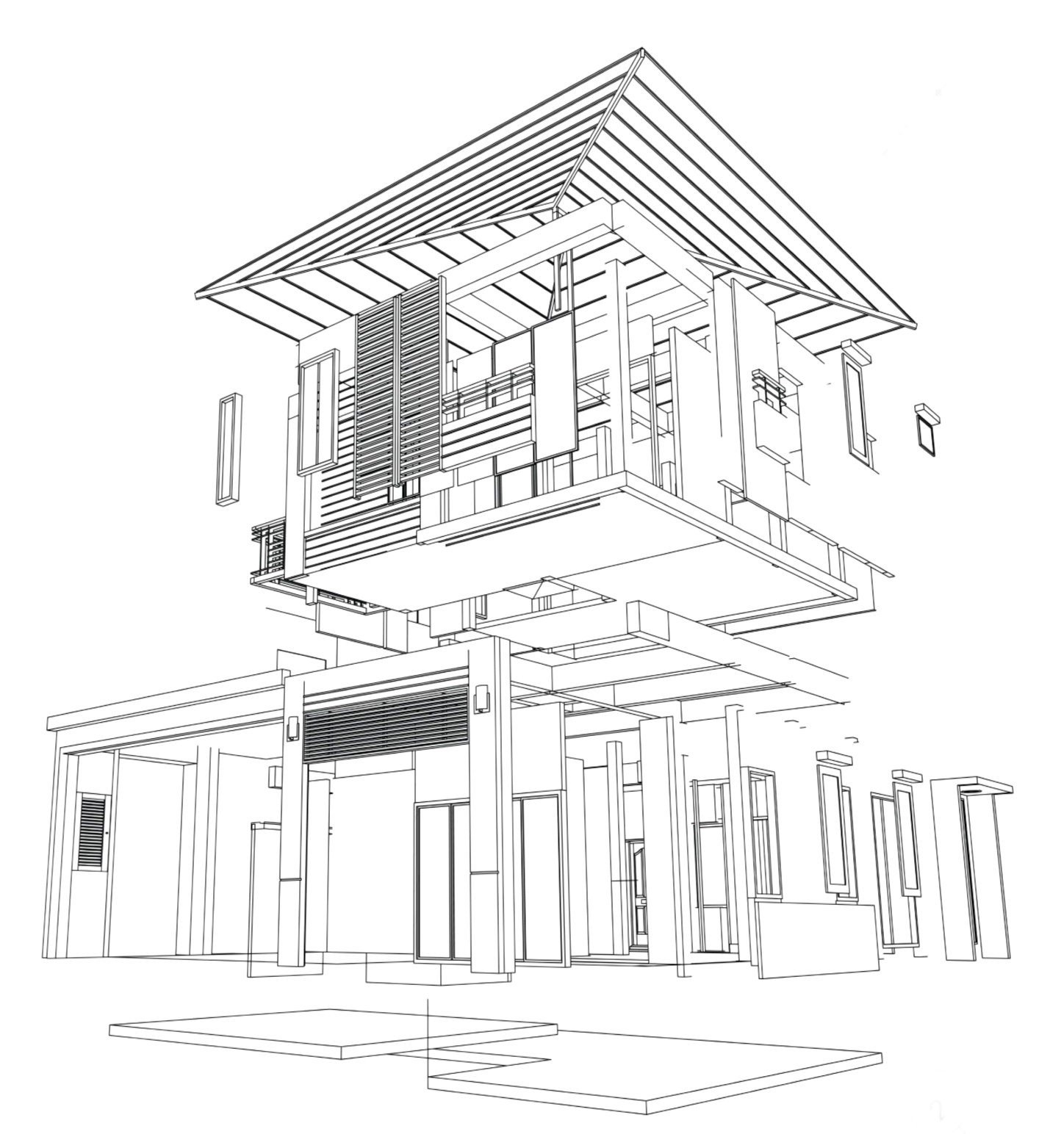

We are proud to announce our newest service offering in partnership with RE Cost Seg – fully engineered cost segregation studies.

Cost Segregation is a powerful tool for real estate owners to increase cash flow by accelerating depreciation deductions and deferring federal and state income taxes.

The time value of money shows us a dollar is worth more today than 10 years from now. This means that the further you can push your taxes out, the smaller they become.

How it works

Traditionally real estate owners depreciate an entire asset over 27.5 years (residential) or 39 years (commercial). Cost segregation allows you to take deductions for real property over the 5, 7 or 15 years of it’s useful life.

At Baldridge Financial we have a robust team of tax, engineering and finance professionals that will analyze your property and work to maximize your deductions.

Ready to learn if you are a good candidate for cost segregation?

Click here to visit RE Cost Seg for a free estimate to see how much you could save